CBN Devalues Naira To 630/$1

The Central Bank of Nigeria (CBN) has devalued the Naira to N631 per dollar, down from N461.6 at the Importers and Exporters (I&E) window the day before.

The devaluation occurred 48 hours after President Bola Ahmed Tinubu announced plans to unify the country’s exchange rate in order to stimulate the economy.

Read Also: Bolanle Raheem: see what Drambi Vandi said as Defendant closes defence

Minutes after being inaugurated as the 16th president of the country, Tinubu stated in his inaugural address, “Monetary policy requires a thorough spring cleaning. The Central Bank must strive for a standardized exchange rate. This will redirect funds from arbitrage into significant investments in the plants, equipment, and jobs that drive the real economy.”

According to experts, the wide gap between the I&E window and the parallel market encouraged round-tripping with Bureau de Change operators.

The situation has prompted the Central Bank of Nigeria (CBN) to devise a number of countermeasures and halt the sale of foreign currency to BDCs.

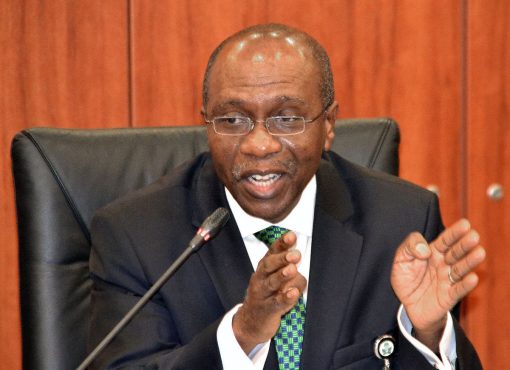

At the presidential villa on Tuesday, President Tinubu met with the heads of strategic institutions, including CBN Governor Godwin Emefiele.

Neither the presidency nor Emefiele disclosed the outcome of the briefing at the conclusion of the meeting. However, it was determined that the exchange rate was discussed at the meeting.

In addition, the President met with Mele Kyari, the Group Chief Executive Officer of the Nigerian National Petroleum Company Limited. It was gathered that the elimination of fuel subsidies was discussed.

At the resumption of weekly bidding for foreign exchange, the apex bank sold the spot rate to banks on behalf of their customers at N631 per dollar, and the majority of bidders received the full amount requested.

One of the customers informed our correspondent that their request was granted for N631 as opposed to N461.6.

The move has also led to a decline in parallel market prices. In Abuja and Kano, prices for a dollar fell from N750 in the early morning hours of yesterday to N745 by the evening.

Also Read: Details of FG’s meeting with NLC, TUC on petrol subsidy removal emerge

On the parallel market, the naira fell to its lowest level in a year due to expectations of a possible change in exchange rate management following Tinubu’s inauguration on Monday.

On Friday, the naira fell from N775 to N762 per dollar on the black market in Lagos, according to Umar Salisu, a BDC operator who monitors the data in the nation’s commercial capital.

Since last week, the unit has steadily weakened on the parallel market after stabilising for the majority of this year.

In the past three years, the market arbitrage (difference between the official and parallel markets) has increased from N100 per dollar or approximately 30% in 2020 to over N400 per dollar (above 100%) sometime last year when the black market rate spiked to N880 per dollar.

Institutions specializing in international development, such as the International Monetary Fund (IMF), are wary of exchange rate differentials in excess of five percent and warn that such disparities could trigger unhealthy manipulations that could hinder other market stabilization efforts.

The CBN spent approximately $42 billion from 2020 to 2022 intervening in the foreign exchange market to stabilise the naira. The amount was sold to end-users, including students and tourists, at the official rates, which are significantly different from the naira’s actual exchange rate.

According to the Financial Stability Report, a publication of the Central Bank of Nigeria, the apex bank sold $9.2 billion in the first half of last year.

The complete data for the second half are unavailable, but the annualized value is assumed to have exceeded that, given the level of social and economic activity associated with the second half.

The black market rate averaged N730 per dollar, whereas the I&E window rate averaged N447 per dollar. This results in an arbitrage of N283/$, which increases the CBN’s FX subsidy for the year to approximately N3.65 trillion.

Thanks for using our platform to learn of the latest Naija News today on CBN Devalues Naira To 630/$1