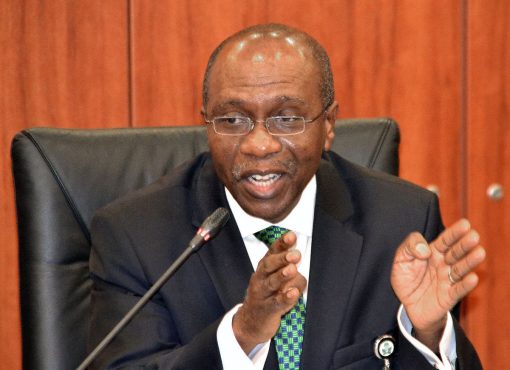

Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele has tasked leaders of the Nigerian banking sector with brainstorming creative solutions to the country’s foreign exchange shortage.

Emefiele, speaking at the 13th annual Bankers’ Committee Retreat in Lagos, emphasised the urgent need to develop the non-oil sector, lamenting that foreign exchange receipts from crude oil sales have dropped from more than $3 billion monthly in 2014 to zero dollars today.

Read Also What is the new CBN policy? Benefits and bad sides of CBN withdrawal limit

“Today, there is a clear shortage of foreign exchange.” However, as bankers, we must meet our customers’ needs. The market is constrained. And I know we don’t have a choice; we’ll have to do something to solve this problem.”

“That is why we decided that this retreat should primarily focus on RT200.”

“How do we begin to think about how to source foreign exchange for our customers‘ import needs without necessarily relying on revenue from crude, which, as you all know, has dropped to nearly zero compared to almost $3 billion monthly that we were receiving in 2014?” he asked.

Pay Attention to ICPC Releases Detained Nigerian Musician, D’banj

Recognizing the impediments posed by high inflation and foreign exchange shortages to the achievement of national development goals, Emefiele stated that the 2022 Retreat, themed “Increasing the Productive Base of the Nigerian Economy and Non-Oil Export Revenues,” was convened to focus on the development of the local manufacturing industry and non-oil sectors in general, and particularly on the sector’s capacity to generate foreign exchange inflows.

He believes the focus is even more important given the magnitude of global economic turbulence, with wave after wave of negative shocks ravaging many countries.

The Governor of the Central Bank of Nigeria emphasised that the expected recovery of the global economy from the Covid-19 shock has been wiped out and replaced by new shocks from the Russian-Ukraine war and the unprecedented stalling of the Chinese economy since the last Retreat.

“Aside from the social costs of despair, destruction, and destitution, they heralded new economic challenges as the energy crisis, cost-of-living crisis, macroeconomic crisis, and climate crisis continue to ravage the world and undermine nation-state policy efforts.”

These significant headwinds have slowed growth momentum, exacerbated global conditions, increased risks and uncertainties, and dampened the global outlook. As a result, like many other countries, Nigeria’s GDP growth rate has gradually declined from 5.03 per cent in 2021Q2 to 3.98 per cent in 2021Q4, 3.54 per cent in 2022Q2, and 2.25 per cent in 2022Q3, he said.

While recognising the Bankers’ Committee’s collaborative programmes and initiatives to deliver tangible contributions to the nation’s economic prosperity, he stated that the RT200 programme was launched in February to stimulate non-oil exports with a $200 billion foreign exchange income target in three to five years.

Noting that the initiative has been widely accepted and driven by the institutions that comprise the Bankers’ Committee, he stated that the retreat provides an opportunity to review the progress of RT200, reconsider support for other government programmes to promote non-oil export and identify specific actions that the financial system can take to increase foreign exchange revenues.

“We can no longer put off addressing the structural issues impeding non-oil export receipts.” “We must strengthen our economy’s immunity and resilience to exogenous shocks,” he charged.

Thanks for reading about the latest news on the Governor of the Central Bank of Nigeria, Godwin Emefiele.