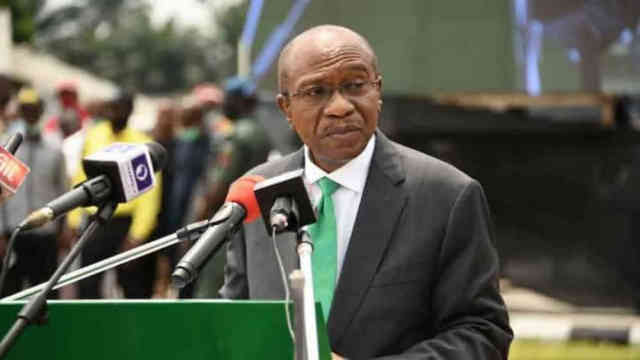

Nigeria’s Bonds Surge After Godwin Emefiele’s Suspension as CBN Governor

Nigeria’s dollar debt increased following the weekend dismissal of Central Bank Governor Godwin Emefiele, as fresh comments on consolidating multiple exchange rates added to indications that President Bola Tinubu is resetting policies held responsible for crippling Africa’s largest economy.

Investors have welcomed the change because it signals a shift away from the former bank chief’s unconventional practices.

Read Also: How Emefiele got me detained for over 100 days because I exposed Forex Scam- Whistleblower says

Long ago, investors, economists, and institutions such as the World Bank criticised Emefiele’s policies, which included allowing a complex regime of multiple exchange rates.

During his tenure, the central bank also loaned former President Muhammadu Buhari’s administration 22.7 trillion naira ($49 billion), contributing to a record 77 trillion naira public debt.

The notes maturing in 2051 reached an all-time high of 73.74, a gain greater than 3 cents per dollar and the largest of the year.

According to a JPMorgan index, the premium investors demand to hold Nigerian debt over US Treasuries fell 46 basis points to 710, the largest decline this year.

The Naira could weaken to 700 per dollar.

JPMorgan stated in a May 31 investment note that the current naira exchange rate of 471.92 naira per dollar may need to be adjusted to approximately N700 to N750, which is closer to the current black market rate.

The naira has declined for three consecutive trading days, its longest losing streak since May 12. Analysts anticipate that the exchange rate will fluctuate between 650 and 750 naira to the dollar as Nigeria permits it to trade more freely.

A naira at this level, coupled with President Bola Tinubu’s decision to remove fuel subsidies, “means the government does not have to borrow as much to pay interest on debt,” according to a series of tweets by the head of strategy at FIM Partners.

Uniform rates

On Monday by phone, Wale Edun, an influential member of Tinubu’s advisory board, told newsmen that the unification of exchange rates was “imminent.”

He stated, “I would estimate that it must be completed within a quarter rather than a year.”

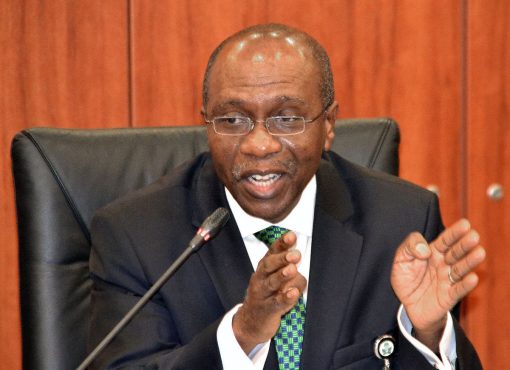

Under Emefiele, the Nigerian central bank offered the U.S. dollar through a number of windows with tightly regulated exchange rates and limited liquidity for businesses and individuals. This drove many people to the black market, where the dollar was traded more freely but at a premium of approximately 60% over the official rate.

Also Read: Dollar to Naira black market exchange rate today June 13, 2023 | Aboki Exchange rate

Emefiele was widely regarded as acting in lockstep with Tinubu’s predecessor Buhari’s administration. This government was perceived to be more statist and socialist, according to Yemi Kale, chief economist for Nigeria at KPMG LLP and former statistician general of the country.

“The markets will respond favourably to a government that they perceive to be more market-oriented,” said Kale.

“To be credible, the implementation of policy changes would likely require a new team,” Ayo Salami, chief investment officer at Emerging Markets Investment Management Ltd in London, said via email, describing the market’s response to Emefiele’s dismissal.

That is the latest naija news today on Nigeria’s Bonds Surge After Emefiele’s Suspension