Adebayo Ogunlesi’s GIP Achieves Historic $12.5 Billion Sale to BlackRock, Reshaping Financial Landscape.

In an absolutely seismic shift within the business realm, Adebayo Ogunlesi’s Global Infrastructure Partners (GIP) is on the verge of a colossal acquisition by the formidable American institutional investment juggernaut, BlackRock Inc., to the tune of a staggering $12.5 billion.

Hold your breath, because this blockbuster deal is slated for its grand finale in the exhilarating third quarter of 2024. Picture this: a cool $3 billion in cold, hard cash and a jaw-dropping approximately 12 million shares thrown into the mix. And would you believe it? These shares, based on the zesty closing prices of January 11, strut around with a sizzling valuation of roughly $9.5 billion.

Adebayo Ogunlesi, the maestro himself, donning the hats of Chairman and CEO at Global Infrastructure Partners, orchestrating this symphony of financial prowess. GIP, under Ogunlesi’s visionary leadership, has etched its name as a heavyweight in the global infrastructure funds management arena. The numbers are nothing short of mind-bending—a portfolio hovering around the cosmic $100 billion mark, with its equity portfolio companies waltzing in with a cool $80 billion in combined annual revenue.

But wait, there’s more. GIP’s star-studded portfolio reads like a who’s who of infrastructure royalty—Gatwick Airport, London City Airport, Port of Brisbane, Port of Melbourne, Sydney Airport, and the showstopper, the Ruby Pipeline, a 680-mile gas pipeline strutting its stuff in the United States.

Cue the crescendo! Bloomberg spills the beans—this deal between GIP and BlackRock is BlackRock’s pièce de résistance since it snatched up Barclays Global Investors in the legendary year of 2009. BlackRock, in a bid to carve out its empire in the pulsating realm of private and alternative assets, is playing this hand with all the aces up its sleeve.

In a memo that practically crackles with the energy of the deal, BlackRock’s dynamic duo, CEO Larry Fink and President Rob Kapito, throw down the gauntlet. They underline the insatiable hunger for fresh infrastructure, from the digital realm to turbocharged logistics hubs, and the crucial arenas of decarbonization and energy security. The rallying cry? Private capital, they proclaim, will be the unsung hero like never before.

Enter the Behemoth: BlackRock Unveiled

BlackRock Inc., standing tall as the colossus of asset management worldwide, flaunts an eye-watering $10 trillion in Assets Under Management (AUM) as of the wild FY 2023 ride—an audacious surge of 16%, eclipsing the $8.59 trillion spectacle from FY 2022. The revenue? A cool $4.6 billion in the blockbuster year of 2023.

Breaking it down—equities and fixed-income assets bring in the lion’s share, a whopping 70% of BlackRock’s assets. The alternative crew (those rebellious assets that aren’t your run-of-the-mill stocks, bonds, or cash) might be the minority at 3%, but they strut into the revenue party like they own the place, contributing a spicy 10%, as per the gospel according to Bloomberg.

Picture this—melding GIP’s powerhouse portfolio with BlackRock’s existing $50 billion in the infrastructure realm. A fusion that’s set to catapult BlackRock into the heavyweight arena of infrastructure assets.

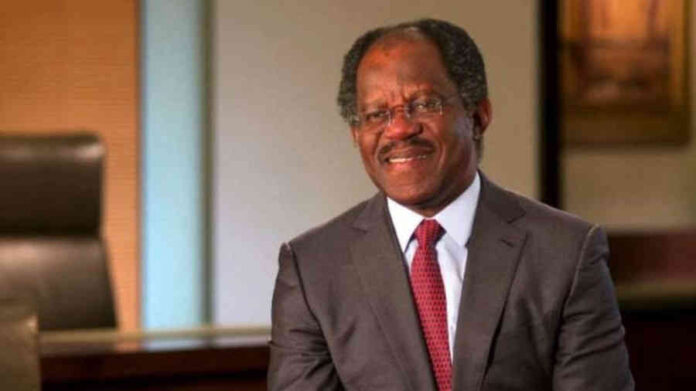

Adebayo Ogunlesi: The Visionary Trailblazer

Now, let’s zoom in on the man of the hour, Adebayo Ogunlesi, a visionary of unparalleled stature. The scion of Theophilus Ogunlesi, Nigeria’s trailblazing first professor of Medicine, and an Oxford University alumnus, Ogunlesi flexes a Bachelor’s Degree in the trifecta of Politics, Philosophy, and Economics. But that’s not all—add an MBA from the hallowed grounds of Harvard Business School to his arsenal.

The year 2006 saw the birth of Ogunlesi’s brainchild, Global Infrastructure Partners, a brainchild fostered with the backing of Credit Suisse and General Electric Co. Prior to this, a glorious 23-year saga unfolded at Credit Suisse, culminating in Ogunlesi’s ascendancy to the position of Executive Vice Chairman and Chief Client Officer of the Investment Banking Division.

Present day? Adebayo Ogunlesi is not just a silent spectator; he graces the Board of Directors at Goldman Sachs. With the curtains falling on GIP’s chapter, the script sees Ogunlesi poised to take center stage on BlackRock’s board and global executive committee.

As the dust settles, this strategic rollercoaster of an acquisition promises to rewrite the narrative of finance and infrastructure investments. BlackRock, with Ogunlesi riding shotgun, heralds a new epoch, leaving an indelible mark on the annals of financial history. Strap in for the ride, because this is a story that’s only just begun.